ESG Finance

Overview of the Sustainability Framework

Use of Proceeds from Sustainability Finance

The net proceeds from sustainability finance will be used for the acquisition of assets in the Eligible Green Projects as provided for in Eligible Sustainability Projects below, refinancing of loans required for the acquisition of assets in the Eligible Sustainability Projects, and for the redemption of the investment corporation bonds that have already been issued (including sustainability bonds/green bonds) for the acquisition of assets in the Eligible Sustainability Projects.

Eligible Sustainability Projects

Eligible Sustainability Projects are assets or projects that satisfy either of the Eligible Green Project Criteria and the Eligible Social Project Criteria shown below.

Eligible Green Project Criteria

Green buildings

New, existing or renovated buildings that have obtained at least one of the following certifications;

| i) DBJ Green Building Certification (Japan): five, four or three stars | |

| ii) CASBEE (Japan): S, A or B+ | |

| iii) BELS (Japan): five, four, or three | |

| iv) LEED (U.S.): Platinum, Gold or Silver |

Contribution to the sustainable growth of local communities

New, existing, or refurbished buildings that contribute to either of items a through d shown below:

| a. Safety of local residents in times of disaster |

| b. Development of the local living environment |

| c. Revitalization of the local community |

| d. Provision of parenting support |

Management of Proceeds

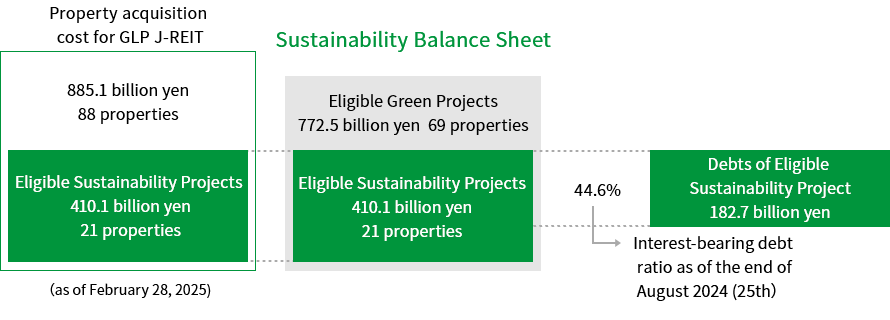

The upper limit of green finance (limit of the "Debts of Eligible Sustainability Projects") shall be the amount calculated by multiplying the total acquisition cost of the Eligible Sustainability Projects by the ratio of actual interest-bearing debt to total assets as of the end of the latest fiscal period that can be calculated on the payment date or loan date of each investment corporation bond, or as of the end of every February.

- Eligible Sustainability Projects that also fall under the definition of Eligible Green Projects under GLP J-REIT’s Green Finance Framework are included both in the total value of Eligible Sustainability Projects and in that of Eligible Green Projects. Any amount of funding provided for those projects in the form of sustainability finance or green finance is included both in the outstanding balance of sustainability finance and in that of green finance. The amount included in the total value and the outstanding balance overlaps between the two forms of finance.

Sustainability Bond Issuance

GLP J-REIT 15th Unsecured Bonds (Special pari passu conditions among specified investment corporation bonds) (Sustainability Bonds)

| Total issue amount | 5,000 million yen |

|---|---|

| Issuance date | September 25, 2020 |

| Redemption date | September 25, 2030 |

| Interest rate | 0.510% |

| Others | Unsecured, not guaranteed |

GLP J-REIT 16th Unsecured Bonds (Special pari passu conditions among specified investment corporation bonds) (Sustainability Bonds)

| Total issue amount | 3,500 million yen |

|---|---|

| Issuance date | December 23, 2020 |

| Redemption date | December 21, 2035 |

| Interest rate | 0.750% |

| Others | Unsecured, not guaranteed |

GLP J-REIT 17th Unsecured Bonds (Special pari passu conditions among specified investment corporation bonds) (Sustainability Bonds)

| Total issue amount | 5,000 million yen |

|---|---|

| Issuance date | March 23, 2021 |

| Redemption date | March 22, 2041 |

| Interest rate | 0.970% |

| Others | Unsecured, not guaranteed |

GLP J-REIT 19th Unsecured Bonds (Special pari passu conditions among specified investment corporation bonds) (Sustainability Bonds)

| Total issue amount | 2,000 million yen |

|---|---|

| Issuance date | February 25, 2022 |

| Redemption date | February 25, 2025 |

| Interest rate | 0.130% |

| Others | Unsecured, not guaranteed |

GLP J-REIT 20th Unsecured Bonds (Special pari passu conditions among specified investment corporation bonds) (Sustainability Bonds)

| Total issue amount | 1,300 million yen |

|---|---|

| Issuance date | February 25, 2022 |

| Redemption date | February 25, 2032 |

| Interest rate | 0.520% |

| Others | Unsecured, not guaranteed |

GLP J-REIT 21st Unsecured Bonds (Special pari passu conditions among specified investment corporation bonds) (Sustainability Bonds)

| Total issue amount | 2,000 million yen |

|---|---|

| Issuance date | December 23, 2022 |

| Redemption date | December 23, 2032 |

| Interest rate | 0.820% |

| Others | Unsecured, not guaranteed |

GLP J-REIT 22nd Unsecured Bonds (Special pari passu conditions among specified investment corporation bonds) (Sustainability Bonds)

| Total issue amount | 2,600 million yen |

|---|---|

| Issuance date | July 26, 2023 |

| Redemption date | July 26, 2032 |

| Interest rate | 0.900% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Issuance

Sustainability Loan Signed in February 2022

| Loan amount | 3,000 million yen |

|---|---|

| Drawdown date | February 28, 2022 |

| Repayment date | February 26, 2027 |

| Interest rate | Base rate plus 0.165% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in September 2022

| Loan amount | 1,000 million yen |

|---|---|

| Drawdown date | September 2, 2022 |

| Repayment date | May 28, 2027 |

| Interest rate | Base rate plus 0.150% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in November 2022

| Loan amount | 800 million yen |

|---|---|

| Drawdown date | November 30, 2022 |

| Repayment date | February 27, 2032 |

| Interest rate | Base rate plus 0.290% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in November 2022

| Loan amount | 1,200 million yen |

|---|---|

| Drawdown date | November 30, 2022 |

| Repayment date | November 30, 2032 |

| Interest rate | Base rate plus 0.290% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in February 2023

| Loan amount | 1,000 million yen |

|---|---|

| Drawdown date | February 28, 2023 |

| Repayment date | May 28, 2027 |

| Interest rate | Base rate plus 0.160% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in July 2023

| Loan amount | 1,261 million yen |

|---|---|

| Drawdown date | July 31, 2023 |

| Repayment date | July 6, 2029 |

| Interest rate | Base rate plus 0.175% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in August 2023

| Loan amount | 3,780 million yen |

|---|---|

| Drawdown date | September 1, 2023 |

| Repayment date | July 12, 2030 |

| Interest rate | 0.93965% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in February 2024

| Loan amount | 1,900 million yen |

|---|---|

| Drawdown date | February 29, 2024 |

| Repayment date | February 27, 2032 |

| Interest rate | 1.100% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in February 2024

| Loan amount | 1,000 million yen |

|---|---|

| Drawdown date | February 29, 2024 |

| Repayment date | February 28, 2031 |

| Interest rate | Base rate plus 0.230% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in February 2024

| Loan amount | 1,000 million yen |

|---|---|

| Drawdown date | February 29, 2024 |

| Repayment date | February 28, 2031 |

| Interest rate | Base rate plus 0.230% |

| Others | Unsecured, not guaranteed |

Sustainability Loan Signed in February 2024

| Loan amount | 1,000 million yen |

|---|---|

| Drawdown date | February 29, 2024 |

| Repayment date | February 28, 2027 |

| Interest rate | Base rate plus 0.175% |

| Others | Unsecured, not guaranteed |

Reporting

GLP J-REIT will continue to disclose the following indicators as of the end of every February so long as it has a sustainability bond finance balance.

Total amount of allocated proceeds/ Amount of proceeds not yet allocated

GLP J-REIT 15th Unsecured Bonds (Sustainability Bonds)

| Total amount of allocated proceeds | 4,967 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

GLP J-REIT 16th Unsecured Bonds (Sustainability Bonds)

| Total amount of allocated proceeds | 3,474 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

GLP J-REIT 17th Unsecured Bonds (Sustainability Bonds)

| Total amount of allocated proceeds | 4,961 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

GLP J-REIT 19th Unsecured Bonds (Sustainability Bonds)

| Total amount of allocated proceeds | 1,987 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

GLP J-REIT 20th Unsecured Bonds (Sustainability Bonds)

| Total amount of allocated proceeds | 1,286 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in February 2022

| Total amount of allocated proceeds | 3,000 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in September 2022

| Total amount of allocated proceeds | 1,000 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in November 2022

| Total amount of allocated proceeds | 800 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in November 2022

| Total amount of allocated proceeds | 1,200 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

GLP J-REIT 21st Unsecured Bonds (Sustainability Bonds)

| Total amount of allocated proceeds | 1,982 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in February 2023

| Total amount of allocated proceeds | 1,000 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

GLP J-REIT 22nd Unsecured Bonds (Sustainability Bonds)

| Total amount of allocated proceeds | 2,600 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in July 2023

| Total amount of allocated proceeds | 1,261 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in August 2023

| Total amount of allocated proceeds | 3,780 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in February 2024

| Total amount of allocated proceeds | 1,900 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in February 2024

| Total amount of allocated proceeds | 1,000 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in February 2024

| Total amount of allocated proceeds | 1,000 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Sustainability Loan Signed in February 2024

| Total amount of allocated proceeds | 1,000 million yen |

|---|---|

| Amount of proceeds not yet allocated | 0 yen |

Reporting on Social Benefits

(1) Output indicators

| Number of properties that are Eligible Green Projects | 20 |

|---|

(2) Outcome indicators

| Emergency shelter for people affected by disaster | 20 properties 13,100 people |

|---|---|

| Standby station for Disaster Relief Teams and Emergency Fire Response Teams in the event of a disaster | 20 properties |

| Backup power supply (72 hours) | 9 properties |

| Stockpile volume of fuel | 26,978ℓ(19 properties) |

| Groundwater facility* | GLP Atsugi II GLP Soja I GLP Zama |

- Some properties have groundwater facilities available for use during a water outage.

(3) Impact

Harmonious relationship with the local community by contributing to the safety and security of the community

Evaluation by an External Organization

With regard to the eligibility of the sustainability finance framework, GLP J-REIT has obtained the evaluation of “SU 1 (F)", the highest JCR Green Bond Evaluation from Japan Credit Rating Agency, Ltd. (JCR), which is a green bond evaluation organization.